Chase try a better option for a checking account which have an excellent lower minimum opening deposit. Pursue checking membership do not have a minimum beginning put, if you are Bank out of The united states examining accounts range from twenty-five so you can a hundred. Chase Safer Banking℠ does not fees overdraft charge; they refuses deals who cause a bad examining harmony. Chase Sapphire℠ Banking and you will Chase Private Client Checking℠ waive the first 4 overdrafts within the current and you can prior several declaration episodes. The brand new Pursue Twelfth grade Checking℠ account are an adolescent savings account intended for college students many years 13 in order to 17. College students are only able to have this account up to they change 19; then, it will be automatically turned into a Chase Full Checking account.

TD Lender Beyond Checking – 3 hundred

- Thankfully, there are many bank offers available to choose from that don’t require head put.

- But wear’t score instantaneously lured within the from the promise from punctual cash.

- Once we step on the January 2025, of numerous loan providers is gearing to provide tempting family savings bonuses to attract new clients.

We have done so and also have fifteen pursue account, biz and private. One of several benefits of financial having Pursue is you get access to a robust branch and you will Automatic teller machine exposure. We and don’t costs an overdraft fee for certain some thing, including if a deal is denied otherwise returned outstanding, and for purchases that are 5 or shorter. You could attempt to select as a result of her or him or take advantage of possibly you can, needless to say.

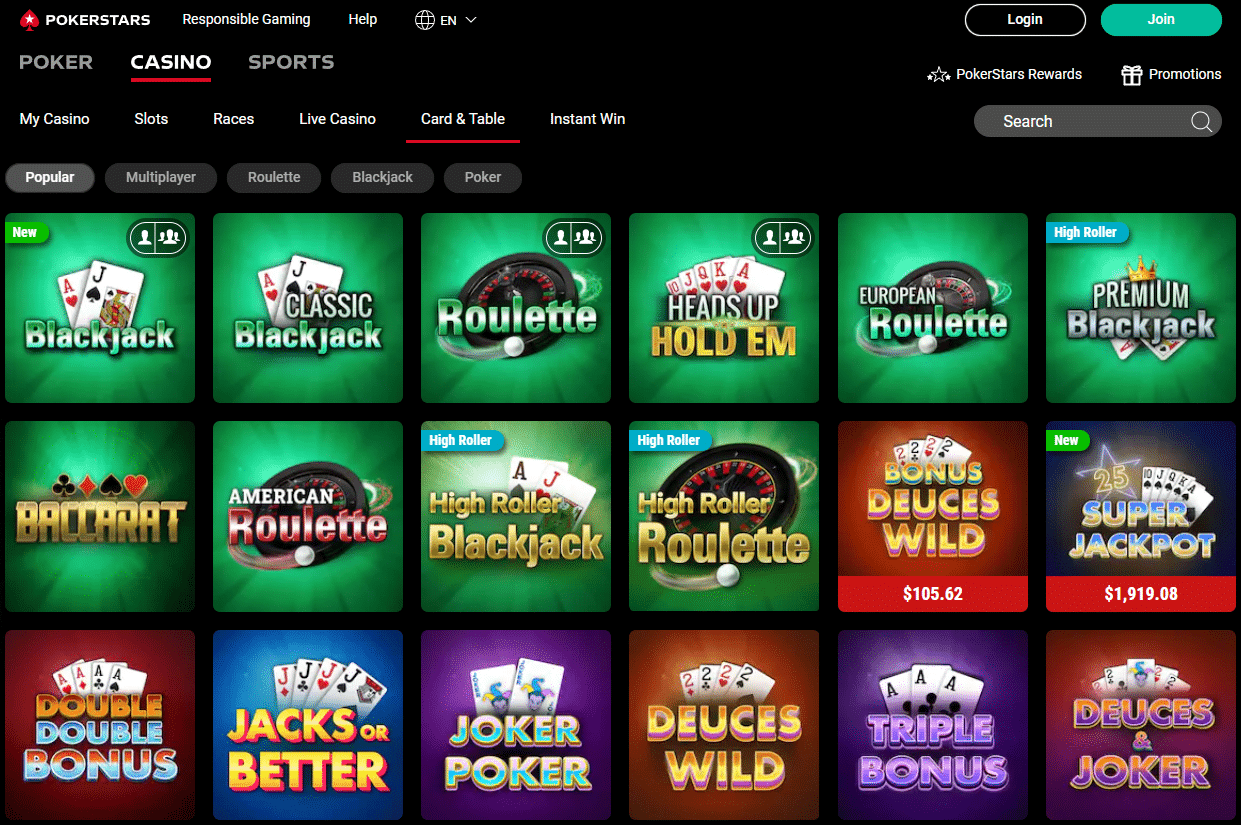

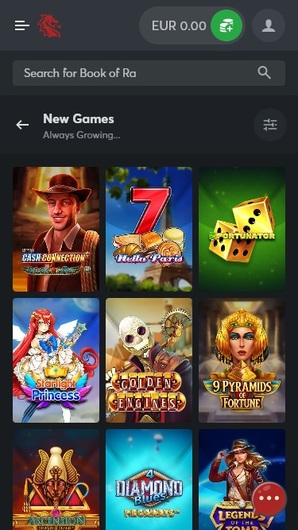

It’s better to select an account with lowest costs, along with incentives such as advantages and highest rates of interest. PNC doesn’t need you to look https://happy-gambler.com/adrenaline-casino/ after the absolute minimum deposit in the account to have a specific period of time. You to fact and also the highest energetic APYs makes these types of bonuses well worth seeking. When you are Huntington’s checking bonuses try steady and you may glamorous now offers, they’re limited in order to users staying in 10 says.

Chase Largest Along with Examining

Really enjoy your outlining your choice about it and you may you can exposure things. What do you determine because the “limited credit card choices” that may twist a threat if the much more attention are on your own account? I imagined about the company banking bonus and you may assume their advice can be applied here also. Help in keeping your money secure having features such No Liability Defense, con monitoring and cards secure.

You might combine Chase SavingsSM with Pursue Premier As well as CheckingSM to earn more. Before you could create, but not, a few you’re capable see all the requirements meanwhile. Fortunately, an identical Chase banking incentives I’m able to take advantage of are available to any or all. A huge Pursue added bonus will always require that you discover a good Pursue Total Examining and you may Chase Discounts℠ account meanwhile. And also you have to satisfy the requirements out of both account to find the main benefit.

Including, if you pay money for automobile insurance month-to-month, you could shell out three months otherwise 6 months in the future. You may even get a discount to own doing so, along with the costs taking you closer to hitting the required paying for your welcome extra. Just make sure you can pay the balance so you don’t score struck having pricey focus fees. TD Bank offers advantages for brand new people who open its TD Complete Checking and you can TD Beyond Checking membership.

We ruled-out now offers which had enough time carrying episodes otherwise requirements one to spanned over numerous report cycles. For individuals who’re wanting to see financial institutions which have immediate indication-right up incentives, you’re in the best source for information. On the other avoid of the line, the customer service associate affirmed the new journey decelerate and i also soon received another text message inviting me to rebook my personal trip to your following day. A few hours afterwards, rain become pouring — just as the airline got predict.

Financial institutions have fun with sign-upwards bonuses to distinguish on their own away from anybody else on the market. Bucks incentives and assist loan providers bring in clients and you can the new places. You might’t mix so it bonus along with other Wells Fargo membership incentives. For those who have obtained a great Pursue checking incentive in the last 2 yrs, you’re not eligible for it give. Chase isn’t really guilty of (and you may cannot provide) people issues, functions otherwise posts at this 3rd-team web site or application, with the exception of services you to definitely explicitly hold the brand new Pursue label. Pursue Largest As well as Checking℠ won’t costs Atm costs in the low-Chase ATMs for fourfold for each statement months.

Learn how to secure hundreds of dollars by just beginning a good examining otherwise bank account if you are experiencing the many perks away from financial having Chase. For many who wear’t meet the requirements out of a checking account strategy, you obtained’t secure the advantage. But not, you could normally keep using the fresh membership and every other perks you’re eligible to own. Acquiring a financial added bonus demands staying the brand new account inside the a good status.

Basically, bank accounts that have high dollars bonuses can get more challenging bonus conditions to satisfy. Such as, you might have to put 25,100000 or more on your own membership inside the basic ninety days and sustain one harmony number for a few months. For each and every standard bank have a tendency to checklist certain requirements you must see by the a designated timeframe.

Neither Pursue nor Wells Fargo offers examining membership as opposed to month-to-month financial repair charge. The newest month-to-month services for the checking accounts at the each other financial institutions is comparable, and you’ll have to satisfy the needs per month on the percentage as waived. You still might believe among its highest-tier checking profile for individuals who on a regular basis manage a leading balance otherwise meet one of the almost every other standards to own waiving month-to-month service costs. One of the recommended Pursue bonuses now available may be worth up in order to 900 if you open one another a good Chase Complete Family savings and you can a good Chase Savings account and you will satisfy particular terms. For those who discover a new Chase Total Savings account and set upwards a primary put (of every matter) in this 3 months, you’ll earn a good 300 bonus.